Put your money in one of the top Money Market Funds

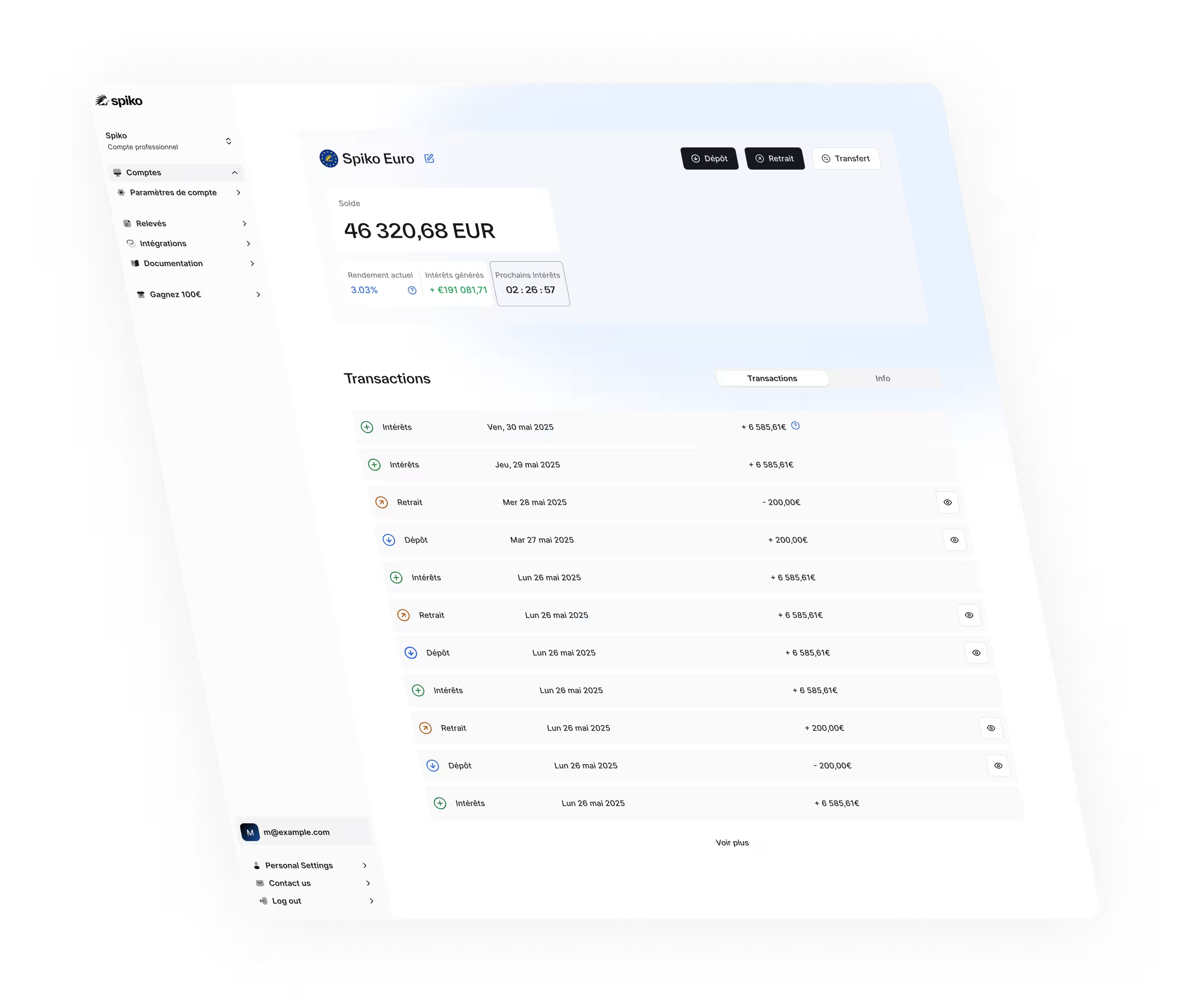

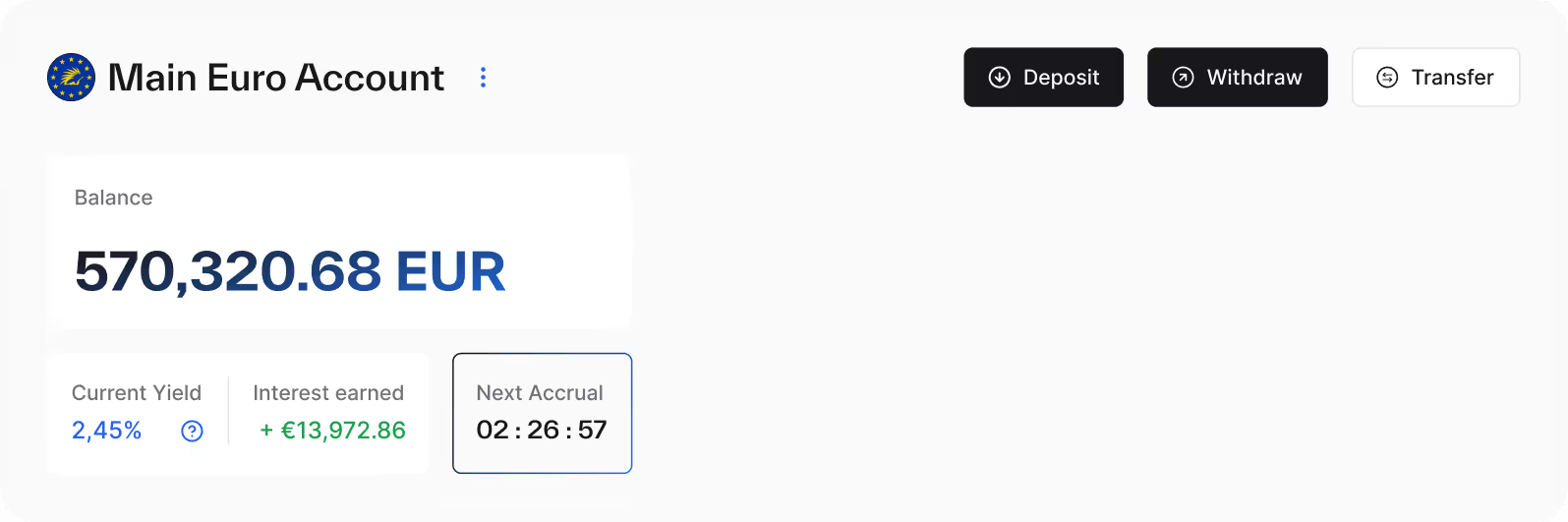

Opt for Spiko’s money market fund to safeguard and enhance your liquidity

It was time to reinvent money market funds

No more hidden fees

No more opaque underlying assets

No more lack of liquidity

A fund unlike any other

Daily interest

Fully secured by Treasury Bills

Withdraw anytime, without notice

First deposit from 1,000 EUR, GBP or USD

Straightforward for your accountant

Regulated under EU law

Find out the cost of your idle cash

Every day your money sits idle, it’s working for someone else.

Annualized net yields (after fees) over the past 31 days. Yields are updated daily and may vary slightly depending on Treasury yields.

Daily interest at the risk-free rate

Your money is safely held by Crédit Agricole’s custody division

Put your cash to work with no hidden costs

Our rates are always quoted net of an annual fee of 0.25%

They trust us with their cash

Start earning interest as soon as tomorrow

FAQ

How do you provide daily access to my funds?

Daily liquidity is contractually guaranteed by the fund's prospectus. In practice, the market for Treasury Bills is the second most liquid in the financial system, right after the forex market. This liquidity lets us sell Treasury Bills in large quantities, ensuring we can meet any withdrawal request.

How is the daily interest determined?

Every business day, the fund's administrator calculates the value of the Treasury Bills in the portfolio, which sets the daily interest rate. On Fridays, the interest is tripled to cover the weekend.

Can the returns on Spiko funds change?

Yes, Treasury yields are aligned with interest rates set by central banks. As a result, the performance of Spiko funds is subject to variations, influenced by monetary policy decisions taken by the US Federal Reserve (USD funds) and the European Central Bank (EUR funds) respectively.

What is the risk-free rate?

In finance, the risk-free rate represents the return on financial assets where the risk of default is so low as to be considered negligible:

- the risk-free rate in USD is the return on Treasury bonds issued by the United States;

- the risk-free rate in EUR is the return on Treasury bonds issued by the strongest countries in the eurozone, such as Germany.

by investing exclusively in such securities, Spiko funds aim to return the capital invested at the risk-free rate in USD or EUR.

Can I use Spiko as an individual?

Absolutely! You can create an account and start using Spiko right away. If you own a company, you can manage personal and business accounts from a single interface. Each account remains separate, so funds cannot be mixed.

Is my capital fully protected?

The Spiko EU T-Bills Money Market Fund exclusively invests in Treasury Bills issued and guaranteed by top-tier countries like France and Germany. While your capital is at risk if any of these countries default on their short-term debt, a sovereign guarantee is usually stronger than a bank's capital guarantee, as banks are more likely to fail than governments. This is why most large companies and institutions prefer parking their cash in Treasury Bills rather than term deposits. To learn more, read our article on capital guarantees.

What are the fees associated with using Spiko?

The only fee for using Spiko is a 0.25% annual management fee on your deposited funds, deducted daily on a prorated basis. The interest you see each day is always shown after this fee has been deducted. You have no fees associated with having an account open at Spiko. You also have no transaction fees on your deposits and withdrawals. Finally, you also have no custody fees.

What is the tax treatment for Spiko products?

In France, both realized gains (withdrawn interest) and unrealized gains (accrued but undrawn interest) are subject to corporate tax.