The alternative to the best high interest savings account

Looking for a short-term investment with full flexibility and strong returns?

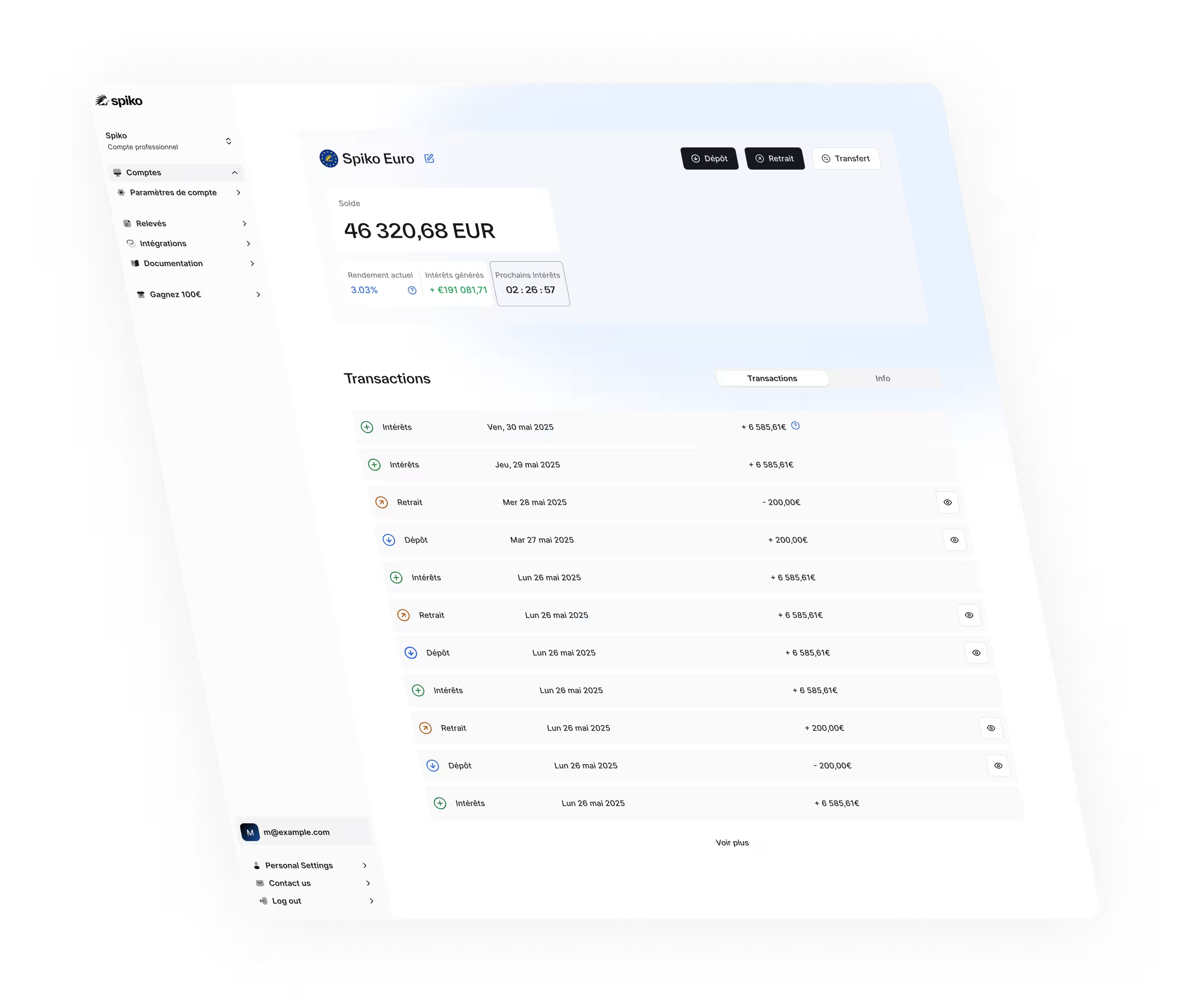

Manage your cash reserves with Spiko

Grow your cash, not your banker’s

Disappointingly weak yields

Monthly fees based on your card

Cap on interest-bearing savings

The best high yield savings account isn't one, compare for yourself.

Every day, we grow hundreds of millions of euros for thousands of customers.

From 5 to 20€ per month

*Includes a 0.7% welcome bonus for new clients, valid for 6 months.

Find out the cost of your idle cash

Every day your money sits idle, it’s working for someone else.

Annualized net yields (after fees) over the past 31 days. Yields are updated daily and may vary slightly depending on Treasury yields.

Put your cash to work with no hidden costs

Our rates are always quoted net of an annual fee of 0.25%

They trust us with their cash

Your cash deserves more than a high-yield savings account

FAQ

How long does a withdrawal take?

Business transfers are instant for amounts up to €100,000 per day

Withdrawals for individuals and amounts over €100,000 are processed every business day at 10:30 AM CET. If you request a withdrawal before 10:30 AM on a business day, your funds will be credited to your checking account on the same day. Requests made after 10:30 AM or on non-business days will be processed on the next business day. There are no withdrawal limits.

What is the tax treatment for Spiko products?

In France, both realized gains (withdrawn interest) and unrealized gains (accrued but undrawn interest) are subject to corporate tax.

Can I integrate my Spiko account with accounting and financial management software like Pennylane?

Yes! Spiko is integrated with an account aggregator used by many platforms such as Pennylane, allowing you to track your Spiko balance and movements alongside your bank accounts.

What are the fees associated with using Spiko?

The only fee for using Spiko is a 0.25% annual management fee on your deposited funds, deducted daily on a prorated basis. The interest you see each day is always shown after this fee has been deducted. You have no fees associated with having an account open at Spiko. You also have no transaction fees on your deposits and withdrawals. Finally, you also have no custody fees.

Is my capital fully protected?

The Spiko EU T-Bills Money Market Fund exclusively invests in Treasury Bills issued and guaranteed by top-tier countries like France and Germany. While your capital is at risk if any of these countries default on their short-term debt, a sovereign guarantee is usually stronger than a bank's capital guarantee, as banks are more likely to fail than governments. This is why most large companies and institutions prefer parking their cash in Treasury Bills rather than term deposits. To learn more, read our article on capital guarantees.

How would I access my funds if Spiko goes bankrupt?

When you deposit funds, they go directly from your checking account to the custodian bank. Similarly, when you withdraw, the funds are sent directly from the custodian bank to your chosen bank account.Because your funds are never on Spiko’s balance sheet, Spiko’s failure would have no impact on them. In the unlikely event that you cannot place a withdrawal through the Spiko interface, you can request your funds directly from the management company by phone or email. The management company is supervised by the French Financial Markets Authority (AMF) and has a business continuity plan in place to ensure customers always have access to their funds.

Can I use Spiko as an individual?

Absolutely! You can create an account and start using Spiko right away. If you own a company, you can manage personal and business accounts from a single interface. Each account remains separate, so funds cannot be mixed.